operating cash flow ratio adalah

Ada beberapa cara untuk menghitung rasio arus kas. The operating cash flow formula can be calculated two different ways.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

To arrive at the operating cash flow margin this number is divided by.

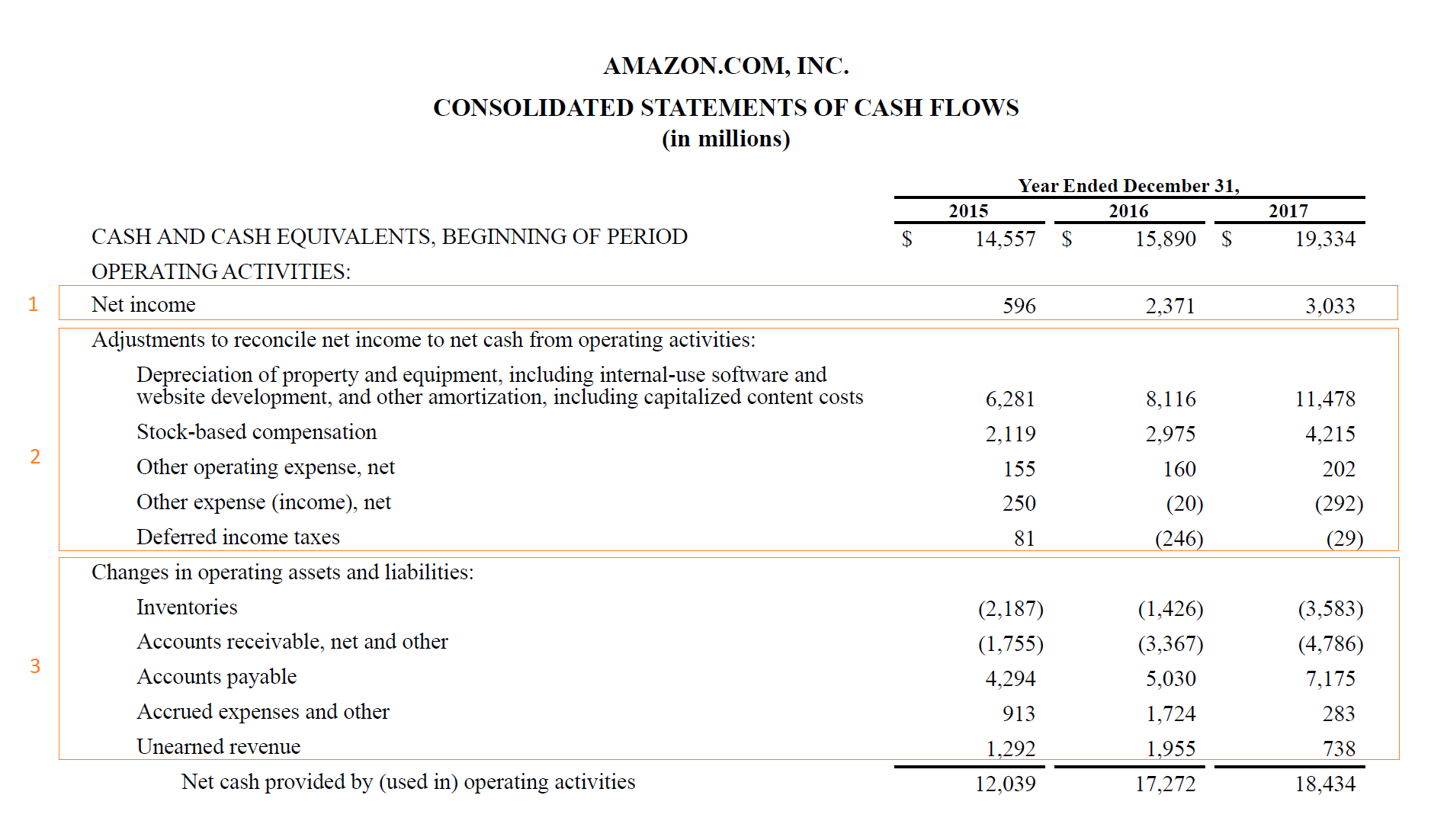

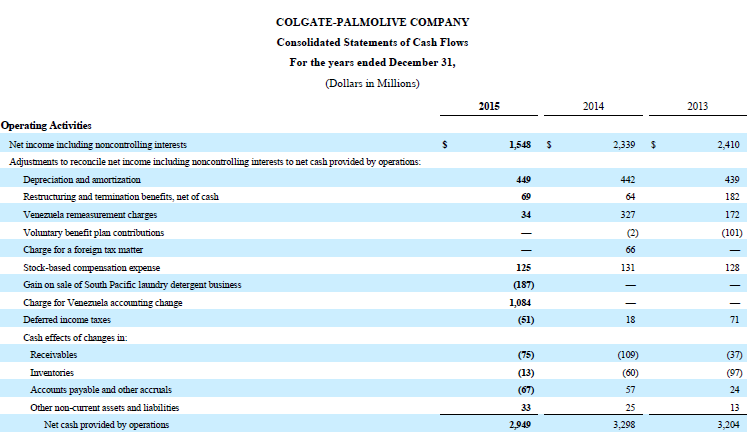

. This calculation is simple and accurate but does not give investors much information about the company its operations or the sources of cash. OCF Sales 4832 3200 1510 in 2015. Cash Flow From Operating Activities 2100000 110000 130000 55000 1300000 - 1000000 2695000.

There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. It shows how much cash a business can generate exclusively from its major operations. Cash flow ratios compare cash flows to other elements of an entitys financial statements.

An example of non-cash revenue is deferred revenue that is being recognized over time such as an advance payment. Bagaimana Cara Menghitung Rasio Arus Kas. The Blueprint walks you through understanding operating cash flow.

Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100. For this cash flow ratio it shows you how many dollars of cash you get for every dollar of sales. The figure for sales revenue can be found in the.

Ada dua metode untuk membuat contoh laporan arus kas atau cash flow adalah metode langsung direct cash flow dan metode tidak langsung indirect cashflow. Aktivitas perusahaan tersebut termasuk. Operating Cash Flow Net Income Non-Cash Expenses Increase in Working Capital Formula long form.

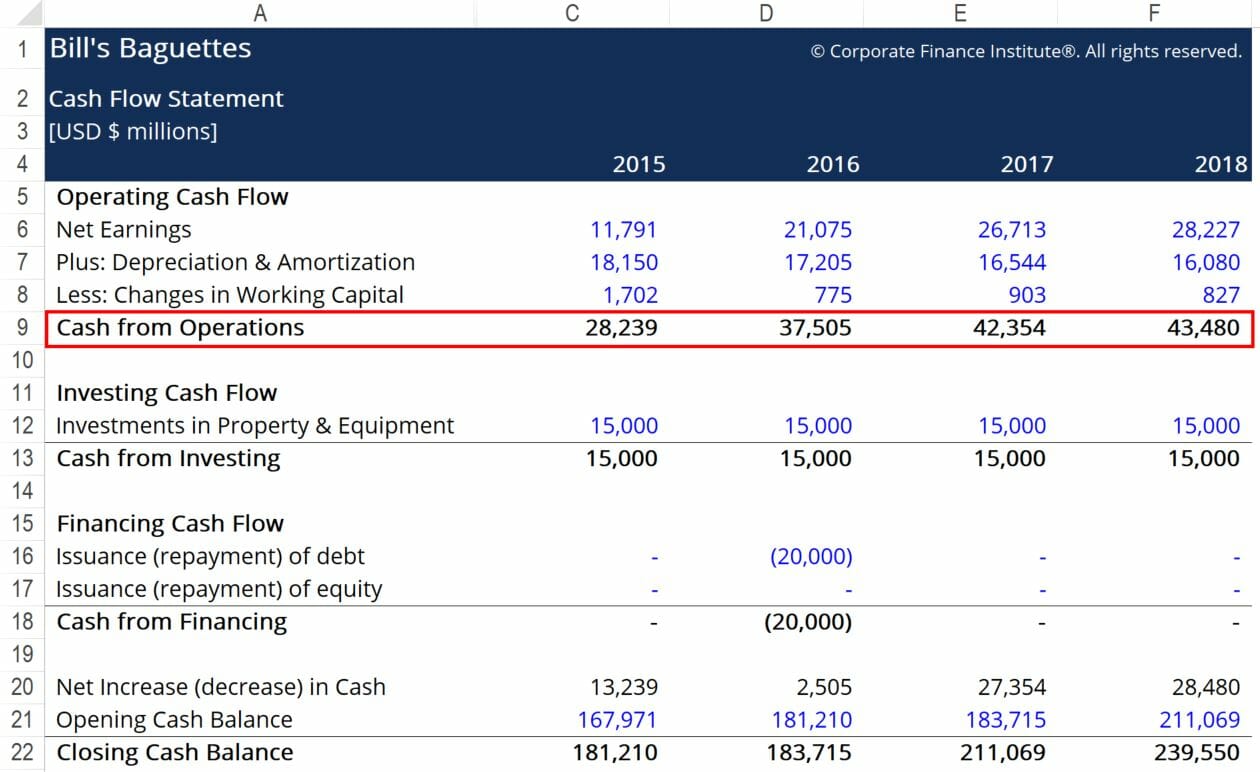

This ratio can be calculated from the following formula. Cash flow from operations can be found on a companys statement of cash flows Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. The operating cash flow formula can provide you with insight into your businesss profitability.

It is also sometimes described as cash flows from operating activities in the statement of cash flows. The figure for operating cash flows can be found in the statement of cash flows. Berikut adalah rumus untuk menghitung operating cash flow ratio.

The calculation of the operating cash flow ratio first calls for the derivation of cash flow from operations which requires the following calculation. A companys operating cash flow to sales ratio gives you an idea of a companys ability to turn sales into available cash. Arus kas dari operasi atau Cash flow from operating activities merupakan bagian dari arus kas perusahaan yang mewakili jumlah uang tunai yang dihasilkan atau dipakai perusahaan dari aktivitasnya sepanjang periode waktu tertentu.

Rumus yang bisa digunakan untuk menghitung cash ratio adalah cash ratio kas setara kas hutang lancar. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. Its ability to pay off short-term financial obligations.

The first way or the direct method simply subtracts operating expenses from total revenues. Operating Cash Flow Ratio Cash Flow from Operations Current Liabilities In this formula Cash Flow from Operations refers to the amount of money your business generates from ongoing business activities. So a ratio of 1 above is within the desirable range.

It should be considered together with other liquidity ratios such as current ratio. Pada contoh rumus cash flow metode langsung merupakan metode membuat laporan arus kas dengan mengelompokkan kegiatan operasi ke dalam berbagai kategori. Below 1 indicates that firms current liabilities are not covered by the cash generated from its operations.

Tetapkan rasio mana yang ingin Anda gunakan. If Christina wants to find out what percentage of cash from operations is generated by the firms annual sales she can use the Operating Cash Flow to Sales Ratio formula. The two had similar ratios meaning they had.

A higher level of cash flow indicates a better ability to withstand declines in operating performance as well as a better ability to pay dividends to investors. What you need to know about the operating cash flow ratio. Operating cash flow to sales ratio.

The cash flow from operations or OCF is a key metric in companies account statements. Nilai dolar pada pembilang adalah harga penutupan saham Zimmer Holdings pada 30 Desember 2005 sebagaimana dilaporkan di media keuangan atau kutipan di internet. The formula for calculating the operating cash flow ratio is as follows.

A higher ratio is better. Berikut adalah langkah-langkah kunci untuk menggunakan cash flow ratio. The operating cash flow ratio is not the same as the operating cash flow margin or the net income margin which includes transactions that did not involve actual transfers of money depreciation is common example.

Investors closely view the OCF as it gives them a clear picture of the companys overall value and health. Low cash flow from operations ratio ie. Operating Cash Flow Ratio Operating Cash Flow Current Liabilities.

PriceCash Flow Ratio ____Stock Price per Share_____. They are an essential element of any analysis that seeks to understand the liquidity of a. Operating cash flow to sales cash flowrevenue x 100.

Unlike most balance sheet ratios where there is a certain threshold you want to look for BV 1 for cheapness debt to equity ratio. Dalam hal ini kas adalah seluruh alat pembayaran yang bisa digunakan untuk melakukan transaksi. It is calculated by dividing its operating cash flow by its net sales revenue and multiplying the total by 100.

Define Operating Cash Flow. Operating Cash Flow per Share. Arus kas dari operasi kewajiban operating cash flow ratio.

Menjual dan membeli barang dagangan dll. Using FCF instead of Operating Cash Flow is a variation you can apply to most of the cash flow statement ratios. Targets operating cash flow ratio works out to 034 or 6 billion divided by 176 billion.

Operating cash flow ratio is an important measure of a companys liquidity ie. Operating cash flow ratio is generally calculated using the following formula. OCF is the amount of cash a business generates from its core activities.

PriceCash Flow Ratio __6744___ 19. Operating Cash Flow Net Income Depreciation Stock Based Compensation Deferred Tax Other Non Cash Items Increase in Accounts Receivable Increase in Inventory Increase in Accounts Payable Increase in Accrued Expenses Increase in Deferred Revenue. Alternatively the formula for cash flow from operations is equal to net.

It is expressed as a percentage. Cash flow from operations serves as a. Income from operations Non-cash expenses - Non-cash revenue Cash flow from operations.

Chapter 11 Statement Of Cash Flows Ppt Download

Everything You Want To Know About Price To Cash Flow Ratio Youtube

Operating Cash Flow Ratio Definition Formula Example

7 Cash Flow Ratios Every Value Investor Should Know Positive Cash Flow Cash Flow Cash Flow Statement

Cash Flow Coverage Ratio Ppt Images Gallery Powerpoint Slide Show Powerpoint Presentation Templates

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Cash Flow From Operations Definition Formula And Example

Free Cash Flow Operating Cash Ratio Free Cash Cash Flow Flow

How Do Net Income And Operating Cash Flow Differ

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Course Title Financial Statement Analysis Course Code Mgt Ppt Video Online Download

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Operating Cash Flow Ratio Definition And Meaning Capital Com

Operating Cash Flow Ratio Youtube

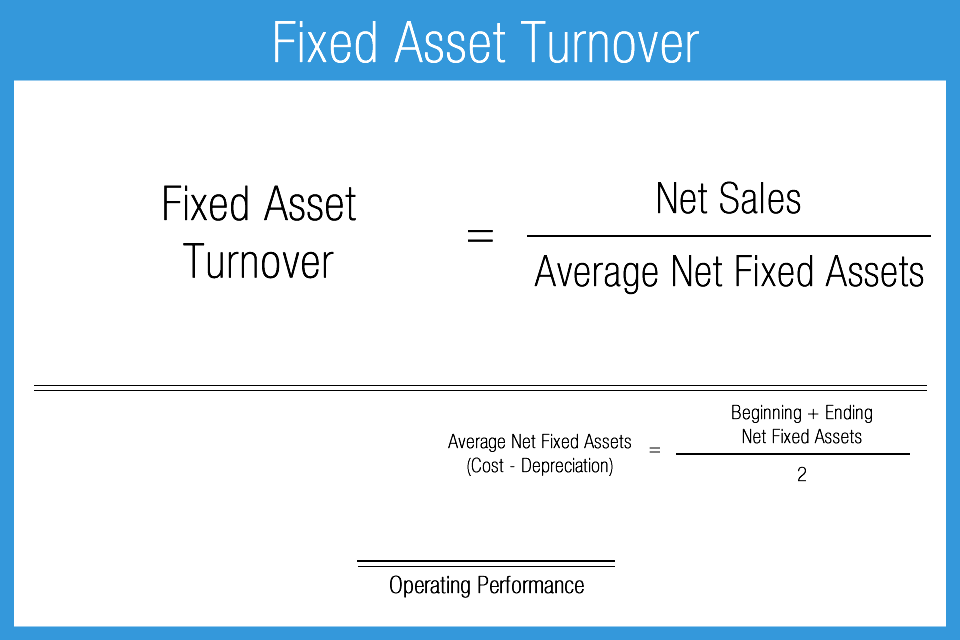

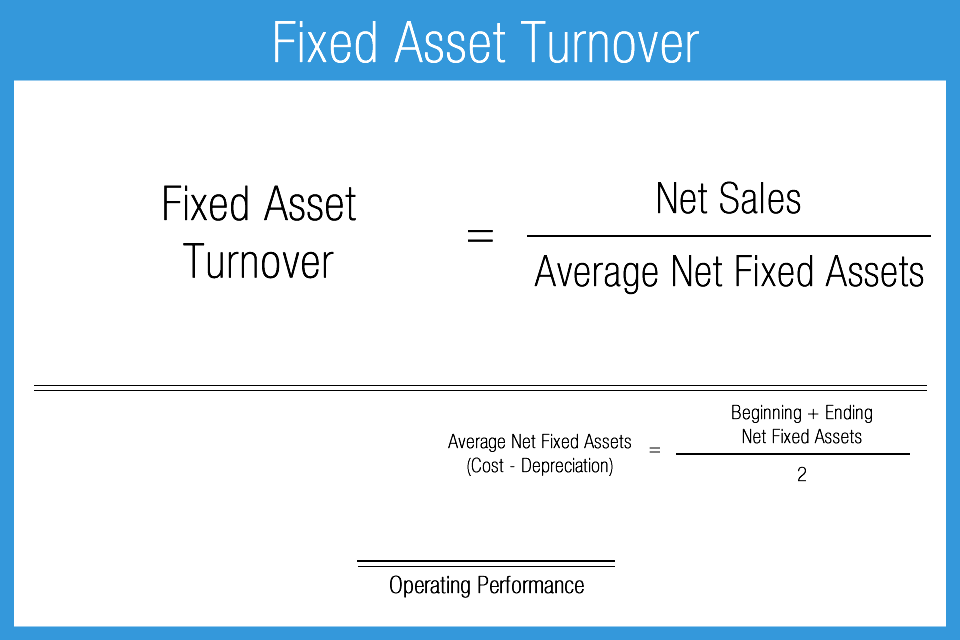

Operating Performance Ratios Accounting Play

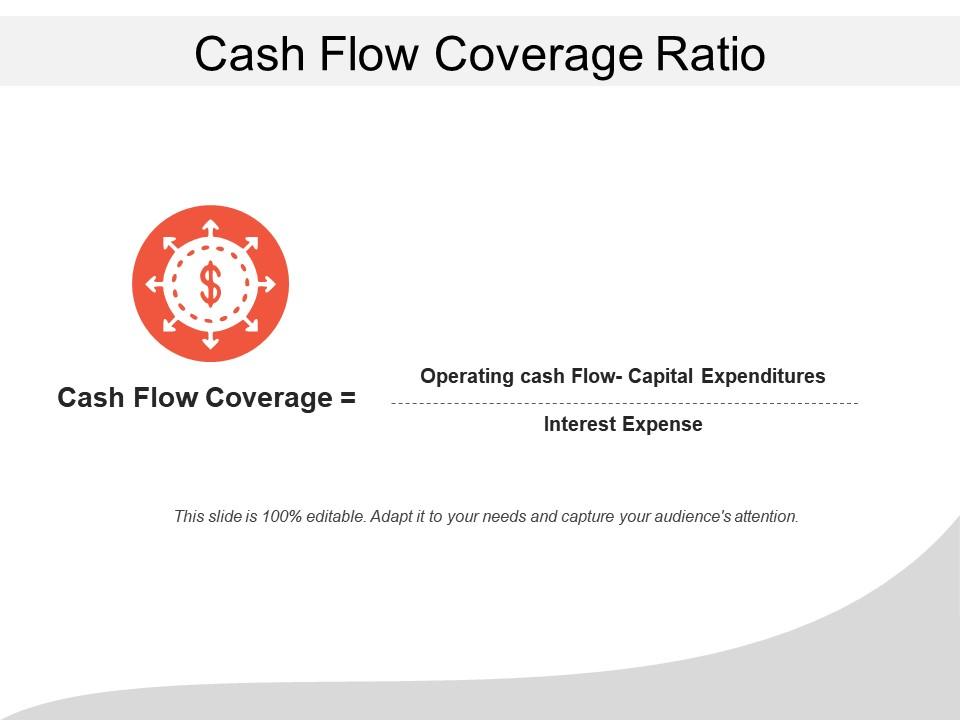

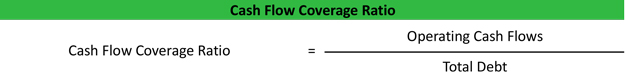

Cash Flow Coverage Ratio Formula Example Calculation Explanation

Cash Flow Analysis Examples Step By Step Guide